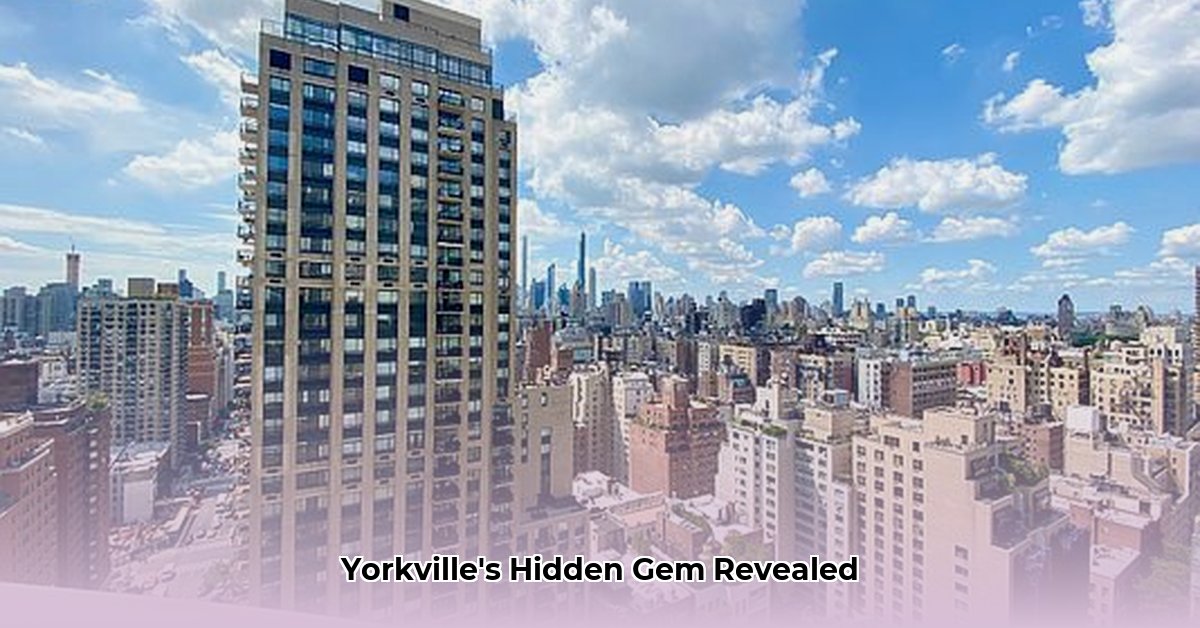

185 E 85th St NYC: A Yorkville Investment Deep Dive

Thinking about investing in Manhattan real estate? 185 East 85th Street in Yorkville presents a compelling opportunity. This article analyzes its investment potential, considering location, building features, market dynamics, and potential risks. Whether you're a seasoned investor or a first-timer, this deep dive provides actionable intelligence to inform your decision.

Yorkville's Charm: More Than Just a Pretty Address

Imagine strolling through Central Park, browsing Madison Avenue boutiques, or visiting the world-renowned museums of Museum Mile – all within easy reach of 185 East 85th Street. This prime Yorkville location offers an enviable lifestyle, significantly boosting the property's value for both residents and investors. The area's prestige and convenience translate into higher rental rates and strong long-term appreciation potential. This isn't just an address; it's an investment in a vibrant, desirable neighborhood. Isn't that an appealing prospect for any investor?

185 East 85th Street: A Closer Look

While specific unit details require further investigation, 185 East 85th Street generally offers features attractive to discerning residents. Expect amenities like a 24-hour doorman (providing security and convenience), central air conditioning (ensuring year-round comfort), modern kitchens, and classic hardwood floors (adding timeless elegance). Some units may even include private outdoor space—a rare luxury in Manhattan. However, a thorough inspection of individual units is crucial before any investment decision. The building's history, including maintenance records and reserve fund status, should also be carefully reviewed to assess long-term stability and potential costs.

Navigating the Upper East Side Market: A Competitive Landscape

The Upper East Side real estate market is highly competitive. A robust comparative market analysis (CMA) is essential to properly evaluate 185 East 85th Street's investment potential. This CMA would examine key metrics like rental rates per square foot, days on market, and absorption rates, comparing the building's performance against its competitors. Long-term factors such as property tax assessments, building maintenance, and the health of its reserve fund are equally crucial to assess long-term financial stability. Understanding these factors is key to understanding the risks and potential returns of this investment. Does your investment strategy incorporate these long-term perspectives?

Actionable Intelligence: A Guide for Different Stakeholders

The investment landscape at 185 East 85th Street presents unique opportunities and challenges depending on your role:

For Potential Investors:

- Conduct Comprehensive Due Diligence: Thoroughly review financial statements, conduct an independent CMA, and consider consulting a real estate professional specializing in the Upper East Side market.

- Project Rental Income: Accurately estimate potential rental income based on comparable units, considering vacancy rates and maintenance costs.

- Develop a Long-Term Strategy: Create a plan that incorporates market trends, potential capital improvements, and adaptability to market shifts.

For Current Owners/Building Management:

- Optimize Rental Pricing: Regularly review market rates and adjust pricing to maximize occupancy and revenue.

- Implement Building Enhancements: Consider upgrades to attract higher-paying tenants and justify premium rents.

- Proactive Maintenance: Maintain a robust maintenance schedule and adequately fund a reserve account for future expenses.

For Potential Renters:

- Compare Available Units: Conduct a comprehensive comparison of 185 East 85th Street with other options, weighing location, amenities, and price.

- Plan Long-Term Costs: Thoroughly evaluate rent, utilities, and any additional fees associated with the building.

Weighing the Risks: A Realistic Approach

While promising, investing in 185 East 85th Street carries inherent risks. The following table outlines potential risks and mitigation strategies.

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Vacancy Rates | Moderate | Moderate | Strategic marketing, competitive pricing, excellent building maintenance |

| Market Downturn | Moderate | High | Diversified investment portfolio, long-term rental agreements, favorable financing terms |

| Property Tax Increases | Moderate | Moderate | Monitor assessments, explore appeals if justified, factor increases into financial models |

| Maintenance Costs | Moderate | Moderate | Detailed maintenance budget, preventative maintenance, substantial reserve fund |

| Management Turnover | Low | Moderate | Choose a reputable management company with a clear succession plan and a strong track record |

Remember, this is for general guidance only. Professional advice is highly recommended.

How to Analyze 185 East 85th Street NYC Investment Potential: Key Takeaways

- Prime Location: Yorkville's desirability significantly impacts rental rates and property appreciation.

- Building Features: Amenities like a 24-hour doorman and private outdoor spaces enhance the property's appeal.

- Market Competitiveness: A thorough CMA is crucial to understand the building's position within the Upper East Side market.

This analysis provides a framework for evaluating 185 East 85th Street's investment potential. However, thorough due diligence and professional advice are essential before committing to any investment.